Discovering SushiSwap DAO

SushiSwap è un'organizzazione guidata dalla comunità creata per risolvere quello che potrebbe essere chiamato "problema di liquidità". Si potrebbe definire questo problema come l'incapacità delle diverse forme di liquidità di connettersi con i mercati in modo decentrato, e viceversa.

SushiSwap è un protocollo Decentralized Finance (DeFi) con un Automated Market Maker (AMM) ed è un fork di Uniswap v2 (a cui dedicheremo le prossime lezioni) che consente agli utenti di scambiare le proprie risorse in modo decentralizzato e senza autorizzazione. Questo lo rende più sicuro, poiché gli utenti hanno il controllo dei loro fondi, ma anche più resistente alla censura, poiché non esiste un punto di controllo centrale.

Il token SUSHI ha visto il suo prezzo salire alle stelle in passato, da un minimo storico di ~ $ 0,50 a un massimo storico di ~ $ 23 nel giro di pochi mesi. Oggi si trova a €1,35.

Chi ha fondato Sushiswap?

SushiSwap è stata fondata nell’agosto 2020 come fork di Uniswap da parte degli pseudonimi Chef Nomi e 0xMaki.

Lanciato inizialmente sulla rete principale di Ethereum, SushiSwap ora supporta più catene, come Polygon, xDai, BSC, Fantom, Arbitrum, Moonbean e pochi altri.

I prodotti sviluppati

Oltre alla funzione principale di Sushi, uno scambio decentralizzato per lo scambio di asset, offre una vasta gamma di altri prodotti. Vediamoli.

• Onsen

Si tratta di un sistema di incentivazione della liquidità che accelera i nuovi progetti fornendo ricompense extra sotto forma di token Sushi che possono essere utilizzati per governare il protocollo. Per essere inseriti nel sistema, ai progetti selezionati viene assegnata una certa allocazione di token sushi per incentivare la fornitura di liquidità per il proprio asset. Il vantaggio di essere nel menu Onsen è che i progetti stessi non sono costretti a incentivare le loro comunità a fornire liquidità per i loro token, perché Sushi lo fa per loro.

• Bento Box

Proprio come il sistema bancario è lo strato di base per le operazioni finanziarie nella finanza tradizionale, il BentoBox è lo strato di base per tutti i futuri strumenti finanziari che Sushi intende offrire.

Bento Box è uno speciale smart contract che funge da caveau per determinati token.

Gli utenti che depositano fondi in uno dei caveau di BentoBox beneficiano di guadagni extra sui loro token. Il caveau può generare rendimenti in diversi modi, ad esempio consentendo ad altri partecipanti di prendere prestiti flash e pagare una piccola commissione che torna agli utenti che forniscono liquidità.

• Kashi

Significa "prestito" in giapponese è il primo protocollo di prestito e trading a margine di Sushi alimentata da BentoBox. Kashi consente a chiunque di creare mercati personalizzati ed efficienti in termini di gas per prestiti.

A differenza di altri popolari mercati monetari Defi come Aave o Compound, Kashi isola ciascuno dei mercati.

Nei tradizionali mercati DeFi le attività ad alto rischio possono introdurre rischi per l'intero protocollo; in Kashi ogni mercato è completamente separato, il che significa che il rischio delle attività all'interno di un mercato di prestito non ha alcun effetto sul rischio di un altro mercato dei prestiti.

• Miso

MISO, Minimal Initial SushiSwap Offering, è una suite di smart contract open source creata per facilitare il processo di lancio di un nuovo progetto sull'exchange SushiSwap, semplificando il processo di creazione di un nuovo token. Nello specifico mira a creare un trampolino di lancio che consentirà alle comunità e ai progetti di accedere a tutte le opzioni di cui hanno bisogno per un'implementazione sicura e di successo nell'exchange SushiSwap.

In tal modo consente al progetto di attirare un pubblico iniziale più ampio di quello che sono stati in grado di raggiungere da soli.

Le difficoltà finanziarie

A gennaio 2023 l’exchange decentralizzato deteneva oltre $ 390 milioni in token bloccati; tuttavia, ha deciso di abbandonare due prodotti come parte dei suoi piani più ampi.

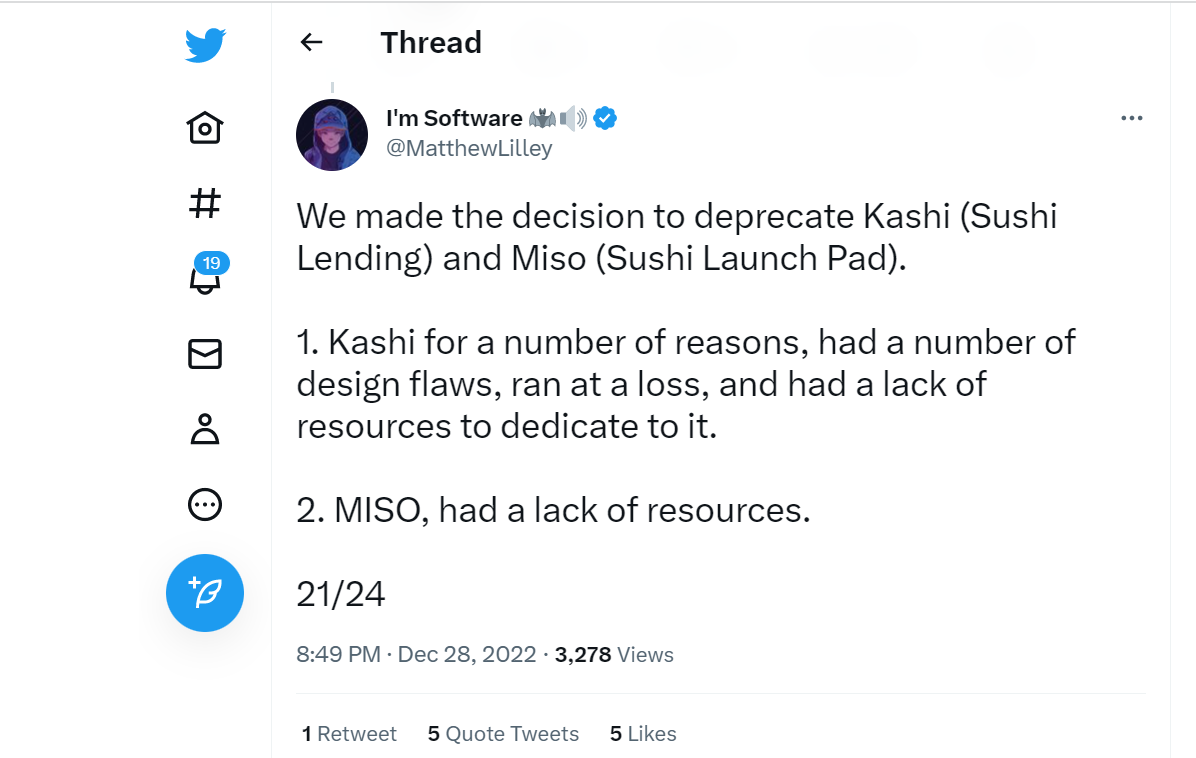

Il Chief Technology Officer Matthew Lilley ha dichiarato in un tweet che due prodotti – la piattaforma di prestito Kashi e MISO – sarebbero stati chiusi a causa dello scarso interesse pubblico e del notevole sforzo profuso per mantenerli.

"Abbiamo preso la decisione di deprecare Kashi (Sushi Lending) e Miso (Sushi Launch Pad)", ha detto Lilley, aggiungendo che i "successori" ancora senza nome di questi prodotti potrebbero essere rilasciati in futuro una volta che Sushi avrà le risorse necessarie per supportare il loro funzionamento.

"Nel terzo trimestre/quarto trimestre è diventato evidente che c'era un forte bisogno di stabilire le priorità e abbiamo deciso di concentrarci sulle idee per migliorare il nostro prodotto più amato e redditizio, il DEX, SushiSwap", ha affermato.

Conclusioni

Nel complesso SushiSwap è un esperimento innovativo che sfida il vantaggio competitivo di Uniswap, un protocollo DeFi ormai consolidato, offrendo una soluzione unica al problema della liquidità delle criptovalute.

A partire dal fork di Uniswap, Sushi ha aggiunto nuove funzionalità al suo protocollo, con la governance della comunità come distinzione principale.

Infatti, il progetto SushiSwap è stato elogiato per il suo forte coinvolgimento della comunità e il suo modello di governance.

Ma questo potrebbe essere sufficiente per portare avanti il progetto anche nel futuro?

Segui le nostre prossime lezioni sul principale exchange decentralizzato UNISWAP ! #staytuned