Introducing ESG DAO Governance: Overcoming the Limits of ESG Funds for Investors

The first point is undoubtedly to improve governance, and there is no shortage of recipes for improving governance but that encounter difficulties and even banal necessities.

A good example can be the management of voting in an advisory committee. Ideally, everyone should be present, informed, and able to know each other opinions, or in some cases, opinions should be protected through confidentiality.

Organizational support for all this is undoubtedly complex and costly.

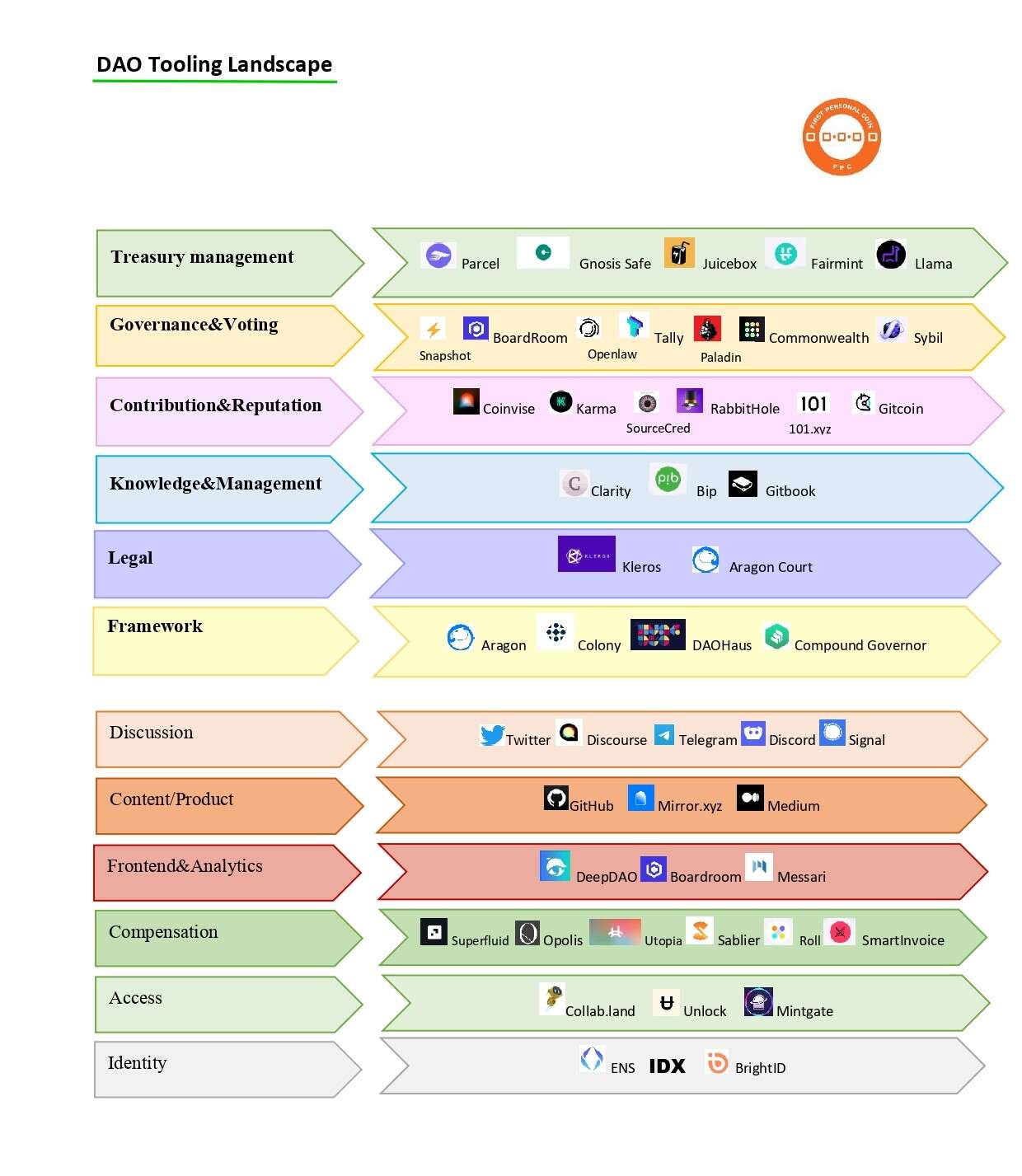

By using a DAO, the duration of the voting can be extended for days, materials can be securely available with restricted access and access verification, alerts and reminders can be automated, and a meeting for discussion can be convened only when notifications have been received that the necessary quorum has been able to document itself online, and the vote can be public or confidential, capital or proportional, but also extended to new systems such as quadratic voting.

This is a further interesting possibility. Quadratic voting is a concept used in decision theory and political economics. It is a voting system designed to allow people to express their preferences more effectively and weightily than traditional majority voting systems. Instead of giving each individual a single vote for each issue, quadratic voting assigns them a certain number of credits votes; that they can distribute among different options based on their preference intensity.

All of this is made possible through sophisticated software, known as smart contracts, which can be programmed to prioritize governance practices that promote transparency, accountability, competence, and stakeholder engagement.

Furthermore, thanks to blockchain technologies, it is possible to have inherent system security, effective communication, and interaction with shareholders, increasing surveillance and ensuring the identity of the counterpart, along with a transactional trace of every step taken.

Adopting the best technologies while ensuring privacy and reliability and involving investors effectively, potentially by providing different investor classes that reward diversified skills, is another opportunity.

In the DAO mechanism, by tracking attendance and votes, participatory mechanisms for management fees can be foreseen for the most diligent parties (based on attendance) or for parties that make more valuable contributions, based on proposals.